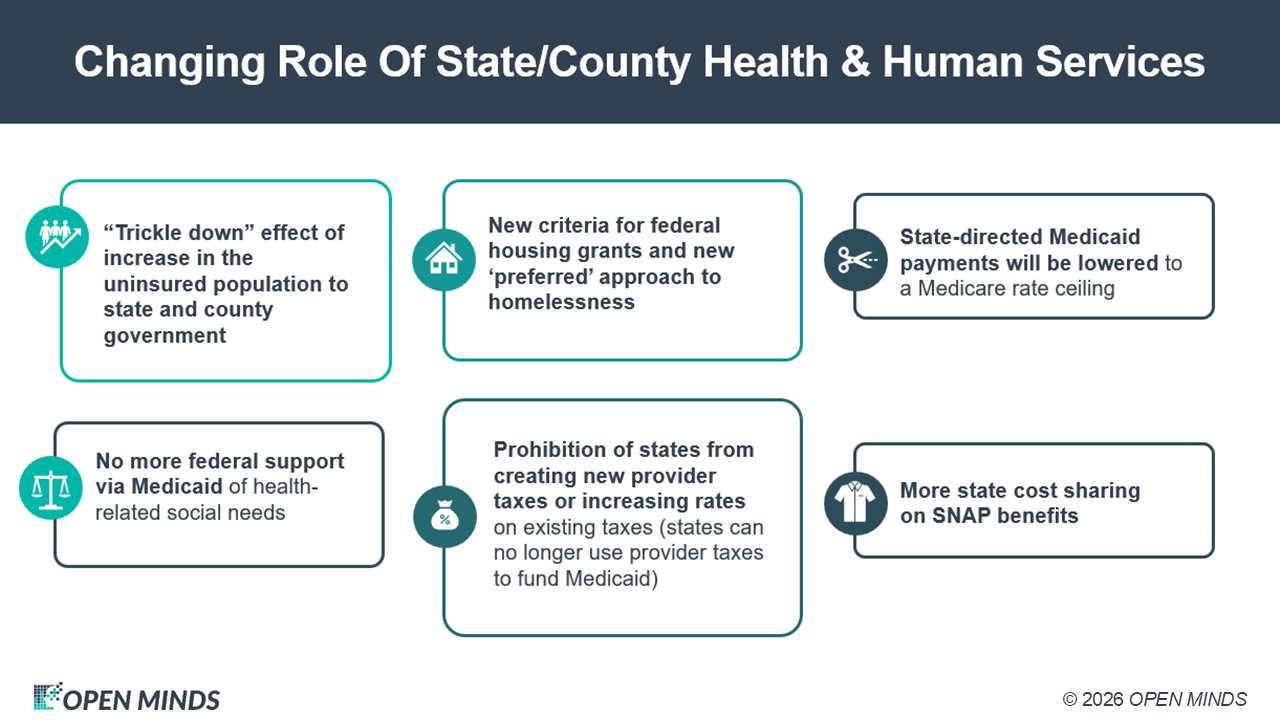

One big question for the year ahead is how state Medicaid plans will be affected by state budget problems. The changes in the last Congressional budget bill affect the financial tools that state governments have to fund Medicaid—particularly the prohibition of states from continuing with provider taxes to fund Medicaid and new limitations on state-directed payments to provider organizations (see Federal Budget Bill Brings Major Administrative & Financing Changes To Medicaid, ACA Marketplace & Medicare).

There will also likely be more uninsured people to serve out of state coffers—an additional 10 to 16 million more (see Rewriting The County Playbook). In addition, states will have to pick up more the costs of SNAP benefits and for meeting the health-related social needs of the…

-

Management Newsletter Issue

|

Building A Marketing Plan That Advances Organizational Strategy: The OPEN MINDS Management Newsletter, January 2026

-

Market Intel Report

|

Medicaid Demonstration & Care Management Waivers: An OPEN MINDS Market Intelligence Report

-

Innovative Program Profile

|

Clinician & Officer Remote Evaluation Program By The Harris Center for Mental Health and I/DD: An OPEN MINDS Program Profile

RFPs

- California Seeks Student Engagement Systems & Services

- California’s Los Angeles County Seeks Non-Medical Case Management Benefits Specialty Services

- Illinois’ Cook County Seeks Tracking Bracelets For Vulnerable Populations

- Maryland Seeks Child Abuse Medical Providers (Maryland CHAMP) Initiative Services

- California’s Shasta County Seeks Drug Test Specimen Collection Services

- Colorado Seeks Early Childhood Mental Health Support Line Call Agent & Statewide Services

- Texas Seeks Service Of Process

- Texas Seeks Pre-Eligibility Services – Child Care Formula

- Ohio Seeks Healthy Eating & Active Living (HEAL) Program Evaluation Services

- Maryland Seeks School-Based Health Center Planning Grant Services

Contract Awards

- Alaska Awards Emergency Medical Services System Evaluation Contract To The Paramedic Foundation

- Texas Awards Inpatient Competency Restoration Program Services Contract To Perimeter Behavioral Hospital Of Garland, LLC dba Perimeter Behavioral Hospital Of Dallas

- New Jersey’s Union County Awards Family Clinic Medical Director Services Contract To Union County Healthcare Associates, LLC

- Hawaii Awards Child Visiting & Family Resource Center Services Contract To Keiki ‘O Ka’Aina Preschool, Inc.

- North Dakota Awards Two Addiction Treatment Services For The East Central District Treatment Court Contracts

Winning Proposals

- Colorado’s El Paso County Awards Domestic & Sexual Violence Services Contract To TESSA Of Colorado Springs

- Alaska Awards Emergency Medical Services System Evaluation Contract To The Paramedic Foundation

- Indiana Awards DD Council Meeting Management & Annual Council Leadership Summit Services Contract To City Rising

- Indiana Awards Workforce Diploma Program Services Contract To Graduation Alliance, Inc.

- Indiana Awards DMHA Prevention Support Services Contract To Indiana University

On-Demand Webinars & Executive Roundtables

- Ethical AI In Behavioral Health: Practical Use Cases That Work

- Scale Is Not Optional: The Growth Imperative For Long-Term Viability

- 2026 Eligibility Must-Knows For Human Services

- Unlocking Value-Based Incentives: Leveraging Technology To Maximize Outcomes

- Open Data Sharing With QHIN™: What It Means For Community Providers

Institute Presentations

- Preparing For Impact: Performance Management As A Financial Sustainability Tool

- Building Stability In Behavioral Health Through Care Delivery With RevDoc– Sponsored By RevDoc

- Reclaiming Time For Care: AI Documentation That Expands Capacity

- The Great Divide: Bridging The Gap Between Clinical & Financial Executives

- From Portals To Participation: Provider Insights On Digital Engagement, Adoption & Performance– Sponsored By Cantata Health Solutions

Market Intelligence Reports

- Medicaid Demonstration & Care Management Waivers: An OPEN MINDS Market Intelligence Report

- Trends In Affordable Care Act Health Insurance Marketplace Enrollment: An OPEN MINDS Market Intelligence Report

- Medicaid Home & Community-Based Services Waivers Covering The I/DD Population: An OPEN MINDS Market Intelligence Report

- Medicaid Care Coordination Initiatives—A State-By-State Guide: An OPEN MINDS Market Intelligence Report

- Largest Health Plans In Each State By Estimated Enrollment: An OPEN MINDS Market Intelligence Report

Upcoming Executive Events

Upcoming Institutes

-

The 2026 OPEN MINDS Strategy & Innovation Institute

June 09 – June 11, 2026 – New Orleans, Louisiana

-

The 2026 OPEN MINDS Service Excellence Institute

August 11 – August 13, 2026 – San Francisco, California

-

The 2026 OPEN MINDS Executive Leadership Retreat

September 29 – October 01, 2026 – Gettysburg, Pennsylvania

-

The 2026 OPEN MINDS Technology & Analytics Institute

October 27 – October 29, 2026 – Philadelphia, Pennsylvania

-

The 2027 OPEN MINDS Performance Management Institute

February 16 – February 18, 2027 – Clearwater Beach, Florida

Upcoming Executive Summits

-

The 2026 OPEN MINDS Autism & I/DD Summit

June 10, 2026 – New Orleans, Louisiana -

The 2026 OPEN MINDS County Health & Human Services Executive Summit

June 11, 2026 – New Orleans, Louisiana -

The 2026 OPEN MINDS Aging In Place Summit

August 12, 2026 – San Francisco, California -

The 2026 OPEN MINDS Health & Human Services Workforce Best Practices Summit

September 30, 2026 – Gettysburg, Pennsylvania -

The 2026 OPEN MINDS CFO Summit

October 1, 2026 – Gettysburg, Pennsylvania -

The 2026 OPEN MINDS CEO Tech & AI Summit

October 28, 2026 – Philadelphia, Pennsylvania

Upcoming Best Practice Seminars

-

MA&A Strategy For A Shifting Market: The 2026 OPEN MINDS Seminar On Planning & Succeeding in Increasing Scale

June 9, 2026 – Virtual Event -

Improving Consumer Experience: The 2026 OPEN MINDS Executive Seminar On Creating Better Engagement & Increasing Revenue

June 9, 2026 – New Orleans, Louisiana -

Optimizing Health Plan Contracting: The 2026 OPEN MINDS Executive Seminar On Building Referrals, Revenue & Margins

August 11, 2026 – San Francisco, California -

Portfolio Management To Optimize Organizational Performance: The 2026 OPEN MINDS Executive Seminar On How To Optimize, Retire & Build A Service Line Portfolio For the Future

August 11, 2026 – San Francisco, California -

Strategic Planning For Times Of Uncertainty: The 2026 OPEN MINDS Seminar On Nimble Data-Driven Planning

September 29, 2026 – Gettysburg, Pennsylvania -

Finding An EHR For Your Future: The 2026 OPEN MINDS Best Practices Seminar On EHR Selection, Implementation & Optimization

October 27, 2026 – Philadelphia, Pennsylvania -

Creating A Winning Tech Strategy: The 2026 OPEN MINDS Seminar On Building A Digital Transformation Roadmap

October 27, 2026 – Philadelphia, Pennsylvania

Upcoming Webinars

-

Are You CCBHC-Ready? Preparing for the 2026 SAMHSA Funding Cycle

March 4, 2026 – Virtual Event -

Breaking the Revolving Door: How an Intensive Crisis Stabilization Center Is Reducing ER Reliance

March 10, 2026 – Virtual Event -

What’s Working in OUD Treatment & System Transformation & ROI of LAI MOUD for Health Systems, Payers & Communities

March 19, 2026 – Virtual Event -

Federal Policy Meets Clinical Innovation: A Conversation with ASTP/ONC

March 24, 2026 – Virtual Event

Upcoming Circle Elite Executive Roundtables

-

A Replicable Framework For Tech Adoption In I/DD Services: The NuPath Case Study

March 5, 2026 – Virtual Event -

‘Strategic Productivity’ In A Hybrid Care Environment: The Southwest Behavioral & Health Services Case Study

March 12, 2026 – Virtual Event -

Financial Mastery For Behavioral Health Leaders: The Hope Group Case Study

March 16, 2026 – Virtual Event -

The Clinician & Officer Remote Evaluation (CORE) Program: The Harris Center & Harris County Sheriff’s Office Case Study

April 9, 2026 – Virtual Event -

Operationalizing Whole Person Care: The VOAMASS Practical Blueprint For Integrated Service Delivery

April 13, 2026 – Virtual Event -

Using Leadership Resilience To Build Financial Sustainability During Market Disruptions: The Integrated Community Alternatives Network Case Study

April 20, 2026 – Virtual Event -

Adopting Technology That Works: Real-World Case Studies In Documentation & Workforce Engagement

April 30, 2026 – Virtual Event -

Designing Nimble Leadership Models For Financial Sustainability: The Acenda Case Study

May 7, 2026 – Virtual Event -

Technology As Capacity & Quality Multiplier: The Monarch Case Study

June 22, 2026 – Virtual Event

Organizational Profiles

- Children’s Home Of Jefferson: An OPEN MINDS Organizational Profile

- Bost: An OPEN MINDS Organizational Profile

- Mental Health Resources, Inc.: An OPEN MINDS Organizational Profile

- United Counseling Service of Bennington County: An OPEN MINDS Organizational Profile

- Tarzana Treatment Centers: An OPEN MINDS Organizational Profile

Innovative Program Profiles

- Safe Options Support Program By Coordinated Behavioral Care: An OPEN MINDS Program Profile

- Family Advocacy & Support Program By Adelphoi: An OPEN MINDS Program Profile

- Multisystemic Therapy (MST) By New Hope Treatment Centers: An OPEN MINDS Program Profile

- The Incredible Years By Coastal Horizons Center: An OPEN MINDS Program Profile

- Clinician & Officer Remote Evaluation Program By The Harris Center For Mental Health & I/DD: An OPEN MINDS Program Profile

News Wire

- HUD Proposes Mandatory Immigration Status Verification For All Residents In Assisted Housing

- Health Care Accounts For Nearly Two-Thirds Of January Job Growth

- Journal Retracts Study On Leucovorin As Autism Treatment Cited In Federal Policy Announcement

- 18 States Urge CMS To Reinstate Targeted Nursing Home Staffing Mandate For Certain For-Profit Operators

- Insurance Carrier Employment Falls For First Time Since COVID-19, Down 29,000 In 2025

- Up To 55% Of French Adults With Chronic Conditions Prefer Remote Care; Up To 51% Would Switch For Earlier Appointments

- Older Adults Whose Loneliness Exceeds Their Social Isolation Have 13% Higher Mortality Risk & 16% Higher Heart Disease Risk

Market Updates

- Women & Infants Hospital’s Community Mobile Health Clinic To Provide Postpartum Care In Rhode Island

- Azara Healthcare Launches Smart Summary AI To Streamline Workflows & Surface Critical Consumer Insights

- Alliance Health Partners With Promise Recovery Network & Wake County On Recovery Hub In Downtown Raleigh, North Carolina

- HHS & CMS Announce Nationwide Medicare & Medicaid Fraud Prevention Strategies

- Pennsylvania Launches $5 Million Grant Initiative To Improve Juvenile Justice Practices

Management Newsletter

Industry Resources

- Peer Support Services: North Carolina Results First Program Evaluation

- Assurance Of Discontinuance In The Matter Of Investigation By Letitia James, Attorney General Of The State Of New York, Of EmblemHealth, Inc., EmblemHealth Plan, Inc., Health Insurance Plan Of Greater New York & EmblemHealth Insurance Company

- Administrative Costs Drive Foster Care Claims & Are Increasing Per Child As Caseloads Decline

- State Medicaid & CHIP Toolkit For Children’s Behavioral Health Services & The Early & Periodic Screening, Diagnostic & Treatment (EPSDT) Requirements

- Prolonged Incarceration Of Children Due To Mental Health Care Shortages

- The Budget & Economic Outlook: 2026 To 2036

- U.S. & State Of Ohio v. OhioHealth Corporation